When you purchase a money order, you pay cash to the equivalent amount upfront: the agency or corporation providing the money order will then “back” up that amount (similar to how a bank backs a check payment), to ensure the receiver gets their due payment. A money order provides an alternative to card payments in a much safer, more reliable form than either cash or personal checks. So, what exactly is a money order, and why would you bother with one in the first place? Essentially, a money order is a form of payment that comes in handy in situations where new school digital payment methods aren’t accepted, or in which you have any concerns about your privacy or security. In a world ruled by Apple Pay and credit cards, most of the younger generation are probably scratching their heads in puzzlement about any payment method that doesn’t involve a piece of plastic or an iPhone. They are extensively well-known way to make a payment, they in no way expire and if they are lost or stolen, they can often get replaced.Ī banknote or check is considered as a good and secure method for receiving cash against goods and services, they also don’t have any expiry date.11 Step-by-Step Guide to Purchasing a Walmart Money Order What is a Money Order?įirst things first, let’s consider the question of what a money order actually is. This may be a useful way to transfer and acquire cash. Money order was the first medium of making payments or transferring cash from one person to another, which now became the pioneer in the modern payment processing. In this era of technology advancements, customers can avail many services over their devices and can transact within a minute. But do not sign on the back of the order. Sign it in the end (purchaser’s signature). Write account number or order number in memo field. Mention your name, recipients name and address in the money order. It is same for western union or US postal provider.

#Money order how to

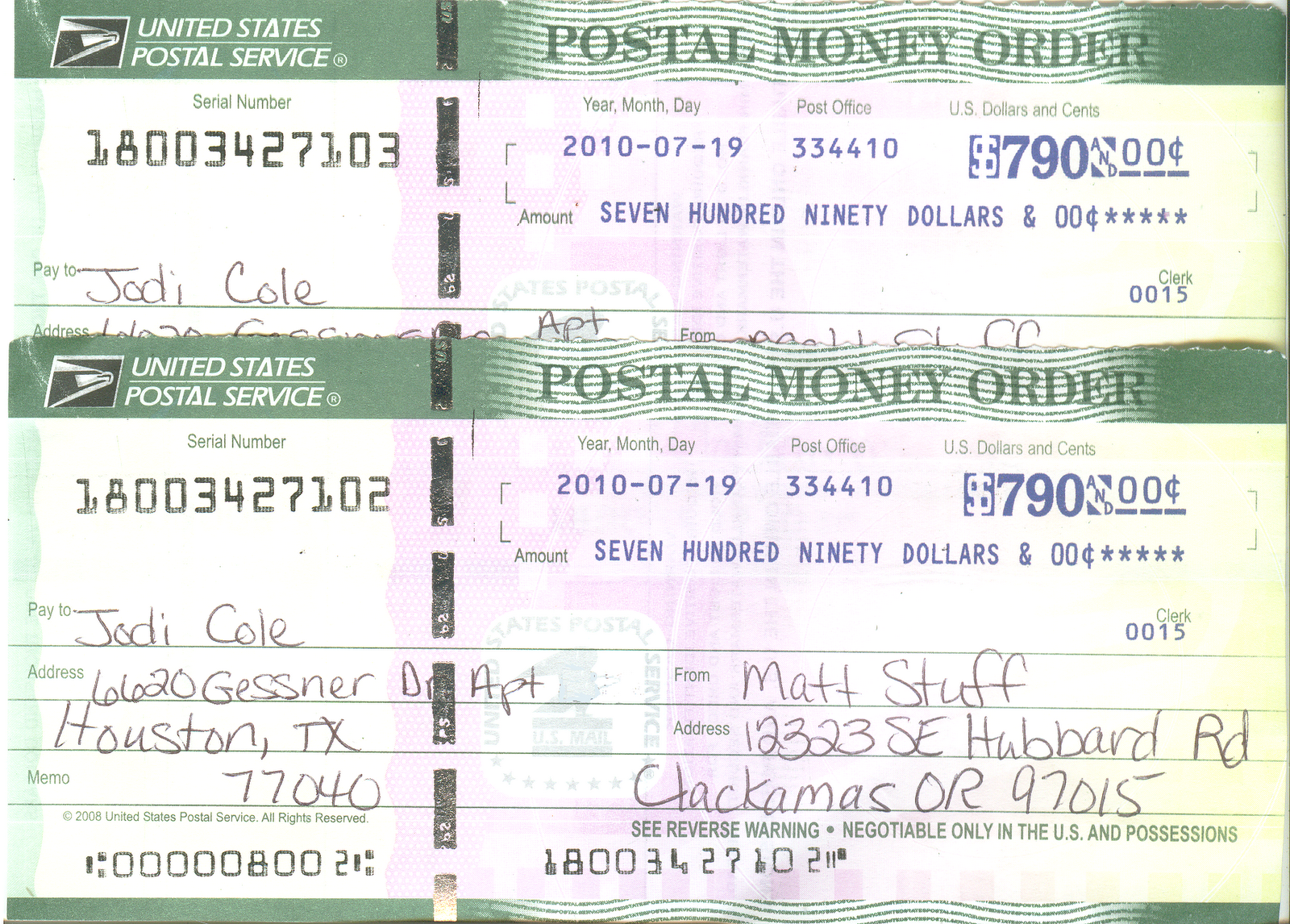

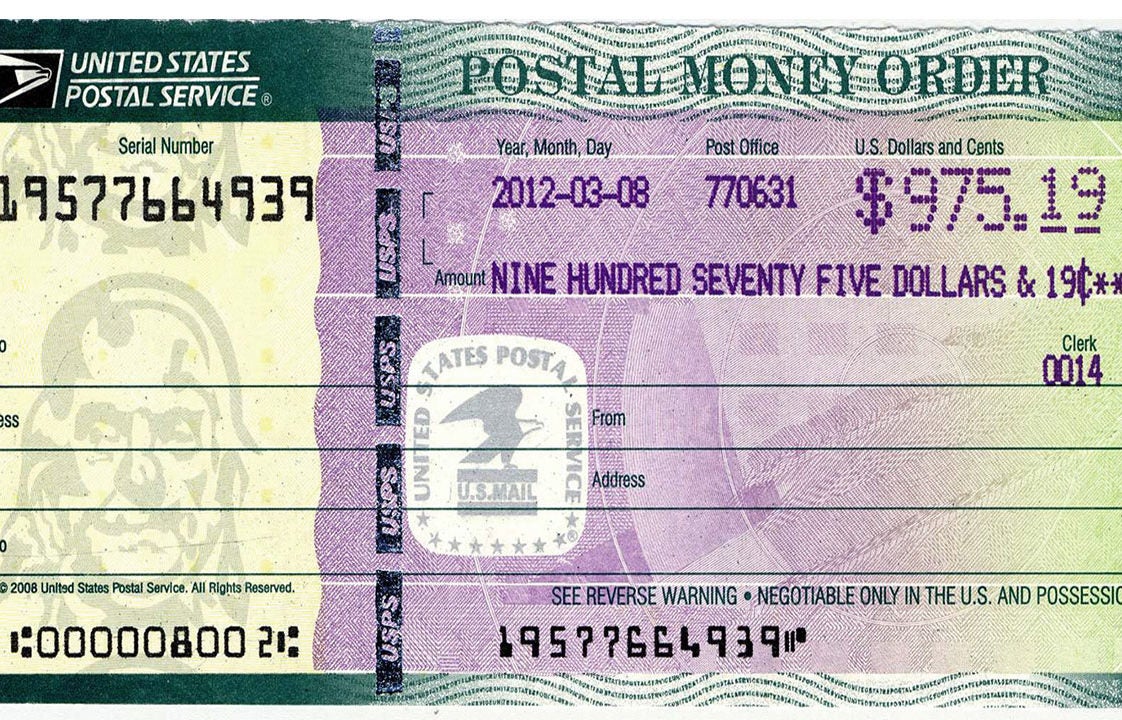

How To Fill Out A Money Order ?įor filing a money order, you need to have all the required information. It is done through a debit card or direct deposit. Such benefits are successful after completing its initial claim process. On Tuesday or Wednesday EDD deposit money. What Day Of The Week Does EDD Deposit Money ? It will be available to you within three business days after claiming for weekly benefits. Generally, it takes five business days in order to set up direct deposit.īut if you are having your debit card with you, then this transfer will be available.

Some banks like Citibank, Wells Fragoallow this mobile deposit for the money order What Day Does Unemployment Deposit Money In NY ?įor direct deposit, you have to login with your NY. Mobile deposit is a part of electronic transaction that you can perform from your mobile phones and other systems. Yes, mobile deposit is possible in a money order. But money order have set limits on transfer through an ATM.įor example: Bank like Wells Fargo allows you to deposit the maximum of 30 bills and checks in one goat its one ATM. Yes, you can use ATM to deposit your money in a bank account. You can cash it at retail outlets like grocery stores having western union or moneygram services. You also have other options to encash your money order. If you cash your banknote through issuer, you will able to minimize your fees. This organization prints and backs the money order. If you do not have any bank account, then you can visit money order issuer. You can also cash your checks through the credit union. Postal Service (USPS) money orders- then the entire amount specified in it will be available to you in one business day. And how much balance of the cash will be available to you within a few business days.īut if you are having a U.S. Such policies specify- How much amount in cash you can get immediately. This happens because of their funds availability policies.

#Money order full

Sometimes banks might not give you full amount specified in a money order in cash. If you are holding a banknote or check then you can cash this in the following places: In Your Bank Account :īanks provide these services to their customers for free. Make sure that your bank accepts mobile deposit before you go for one. Many of banks don’t allow banknote deposit in any respect. Banks may also require you to deliver the original order for your bank for processing.

Use caution whilst using your mobile device to deposit this cash orders.

It can also be listed separately (as a check) on your deposit slip. Depositing a money order is considered same as depositing a check into your account.

0 kommentar(er)

0 kommentar(er)